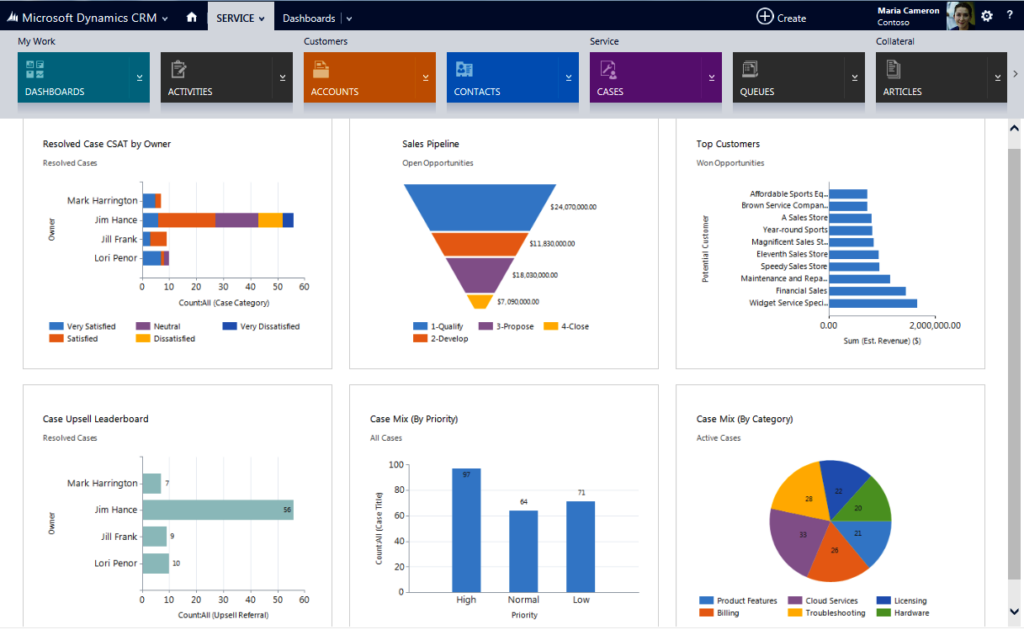

The Investment Platform for Family offices is built on the Dynamics CRM platform and implements the best practices of working with successful, global, and multi-generational families. Family office or Single family office (SFO) can now manage investment, trusts, property management, day-to-day accounting, payroll activities, and legal affairs.

SAI solution for Family Offices provides the following functionalities

Manager due diligence and selection

Implements framework for advisors to derive their investment decisions based on process, checklist, and questionnaire. Opportunities can be sourced and filtered based on Portfolio sustainability, and Independent research.

Research Management

Investment policy and decision-making with the help of crucial real-time research data feed, automatically filtered, and tagged for funds of interest.

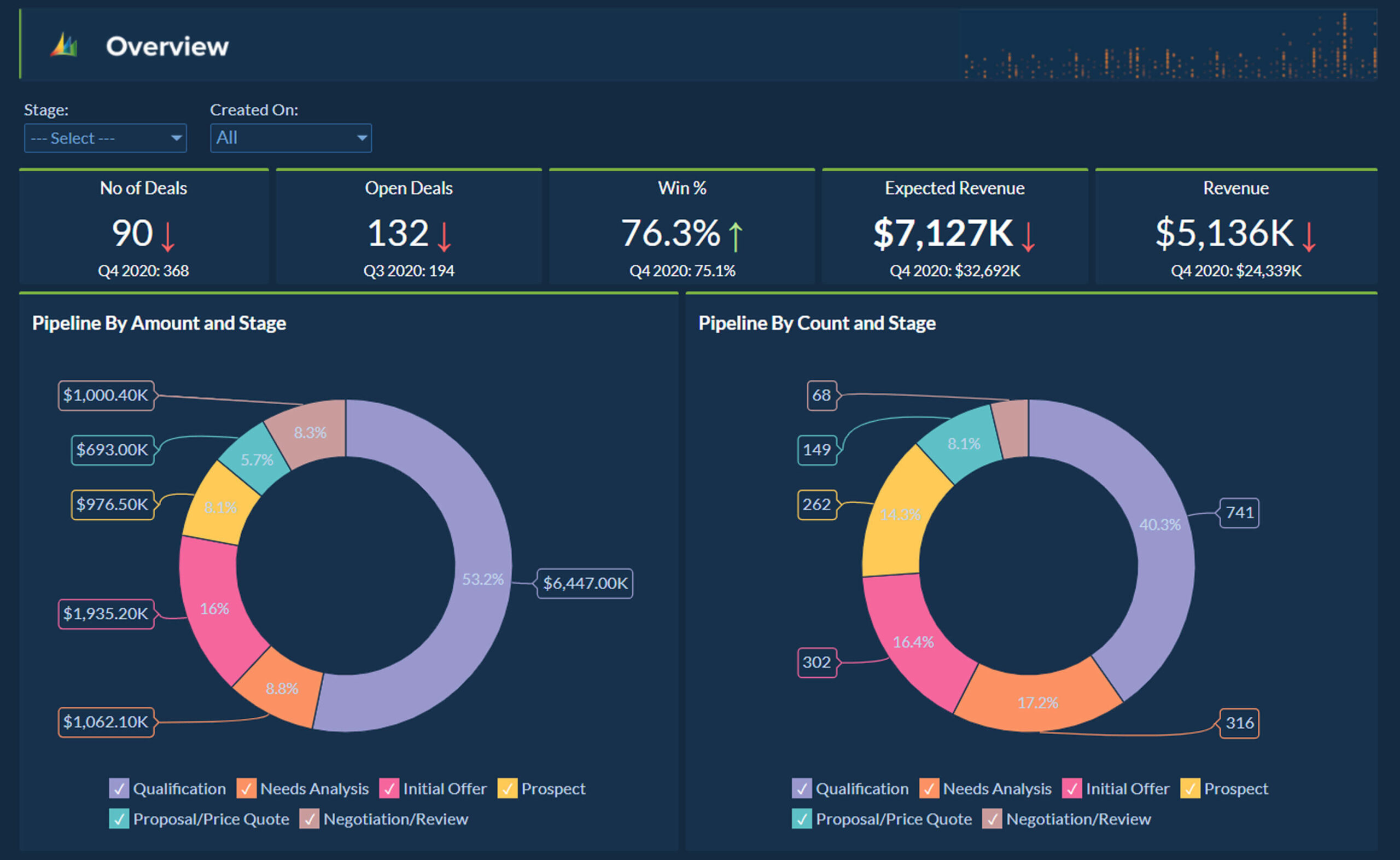

Portfolio Management and Performance Reporting

Monitor account performance with support for fixed-income funds and hedge fund redemptions. Portfolio accounting (transaction-level detail) and performance analytics based on asset allocations.

Regulatory and Financial Compliance

Proactive rule checking to define trading and portfolio policies. Automate preventive trade validation, overrides, and process to check pre and post-trade compliance. Test and record compliance and compare with client commitments.

Trading and Order Management

Workflow to manage Portfolio construction (Asset Allocation and Portfolio Rebalancing), Trading Execution, Post Trade (Allocation and Custodial Notification), and Compliance (Pre and post-trade)

Manage non-financial best practices

Help clients with Family Cohesiveness, Strategic Planning, Philanthropy, Family Governance, and Trustee & Beneficiary Relationships.

More to read: SEO Companies for real estate business